HNEF II Fund Structure

- $42 million quadruple bottom line private equity fund

- Meets the need for patient, lower cost, long-term equity capital

- 6% target return to Limited Partners

- 10-year investment term

- 2% management fee

- 5% first loss reserve reduces risk and protects yield to Limited Partners

- Diversified portfolio of real estate investments mitigates concentration of risk

HNEF I Track Record

- HNEF I – our first Fund – is fully invested in a portfolio of nine projects in greater Boston for a total of $21.3 million

- Investments are in Boston (5), Chelsea, Braintree, Haverhill and Beverly. Seven are completed and are either operational or in lease-up. One Boston project has already exited

- These nine investments have leveraged an additional $144 million in private and public investments in low- and moderate-income neighborhoods, resulting in the creation of 586 new mixed-income homes and 139,423 sq. ft. of commercial space

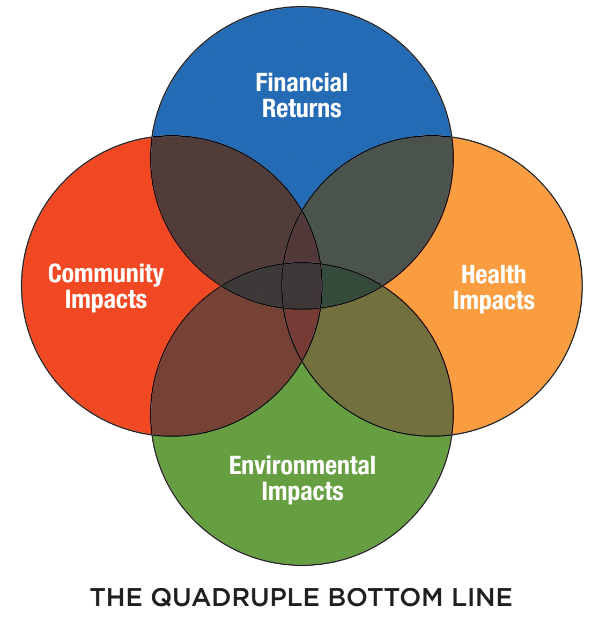

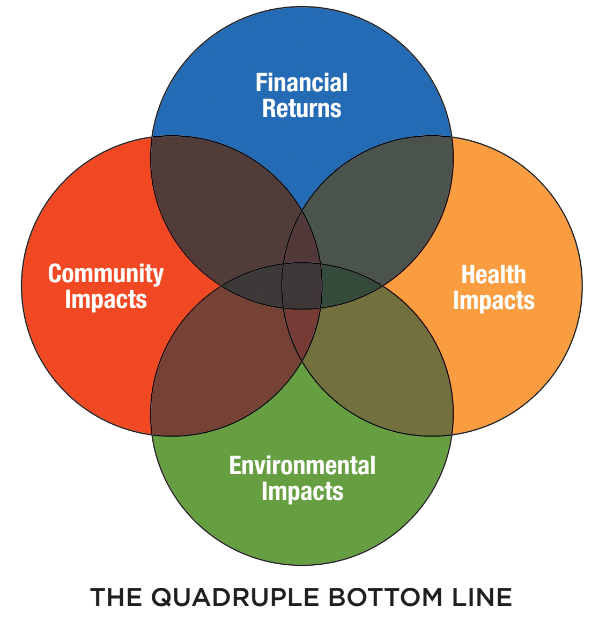

The Quadruple Bottom Line

- HNEF's Quadruple Bottom Line approach to evaluating potential investments considers community, environmental, and health impacts in addition to financial returns